15 Money Lessons Parents Should Teach Kids Before It’s Too Late

Teaching kids practical money lessons early is crucial for their future well-being. The habits and attitudes children form about money can dictate their financial security, independence, and decisions as adults. Early financial education helps them develop smart saving, spending, and investing strategies that last a lifetime. According to a CFPB report, starting young ensures better money management in adulthood. Don’t wait—instill these vital skills before it’s too late.

1. The Value of Money

It’s essential for kids to learn that money is earned through hard work and effort—not just handed out. By linking chores or responsibilities to allowances, parents demonstrate the direct connection between work and financial reward. This approach helps children appreciate the true value of money and fosters respect for both spending and saving. Studies suggest that earning money through tasks builds stronger financial habits early on, laying the foundation for responsible financial behavior in the future.

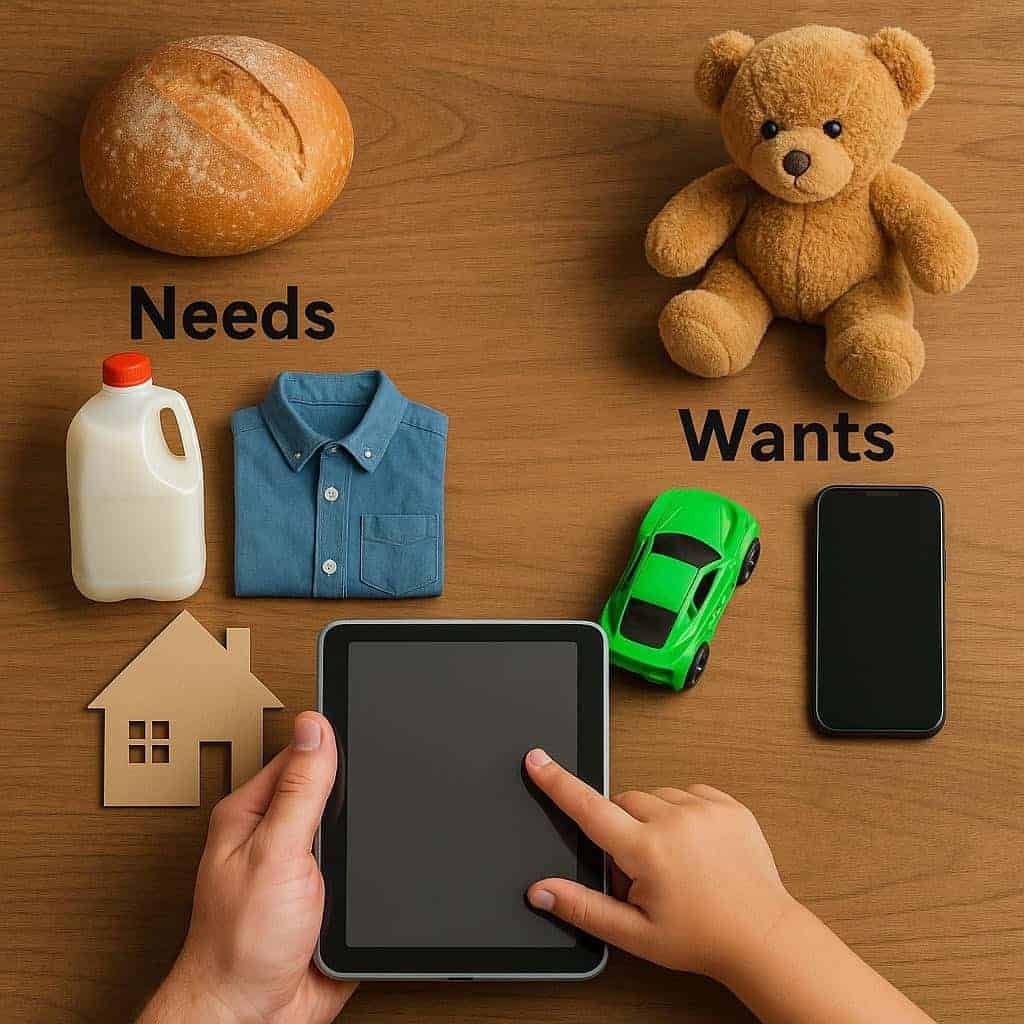

2. Needs vs. Wants

Understanding the distinction between needs and wants is crucial for smart money management. Needs are essentials like groceries, clothing, and shelter, while wants include things like toys or the latest gadgets. When shopping, encourage kids to categorize items—ask if something is truly necessary or just a desire. This practice not only builds awareness, but also lays the foundation for future budgeting skills. Teaching kids to prioritize needs over wants is supported by financial experts, helping them make wiser financial choices.

3. Saving Before Spending

Teaching kids to save before spending encourages a lifelong habit of financial responsibility. Encourage them to set aside a portion of any money they receive—whether from allowances, gifts, or chores—before making purchases. Using a clear jar or bank lets children visually track their savings growth, reinforcing positive behavior. This simple principle mirrors adult strategies like “pay yourself first,” which is key to long-term financial stability. Early practice helps kids prioritize saving as they grow older.

4. Setting Financial Goals

Learning to set financial goals helps kids understand the value of planning and patience. Whether saving for a new bike, a favorite book, or another special item, having a clear target gives purpose to their efforts. Breaking larger goals into smaller milestones keeps motivation high and makes achievements feel more attainable. Visual tools like charts or goal trackers can help kids see their progress and stay engaged in the process. Experts recommend these strategies to build lasting money habits.

5. The Power of Delayed Gratification

Teaching kids to resist impulse buys and wait for something more meaningful builds essential self-control. The famous marshmallow test showed that children who could delay gratification enjoyed greater success as adults. By saving for a special item instead of spending immediately, kids learn patience and the rewards of thoughtful choices. This practice fosters better financial decision-making and strengthens self-discipline, equipping children with skills that benefit them well beyond childhood.

6. Making a Simple Budget

Introducing kids to basic budgeting sets the stage for sound financial habits. Help them divide their money into categories such as savings, spending, and sharing. Practical tools like simple spreadsheets or the envelope system can make this concept tangible and easy to understand. Early exposure to budgeting not only teaches math skills but also instills discipline and organization. According to Consumer.gov, starting this practice young can lead to effective money management skills that last a lifetime.

7. Smart Shopping Habits

Teaching kids smart shopping habits encourages thoughtful spending. Show them how to compare prices, look for sales, and read product reviews before making purchases. Making a shopping list and sticking to it helps avoid impulse buying. Discuss the concept of “value for money” so kids understand that the cheapest option isn’t always best. These skills foster wise consumer behavior and help children make better financial choices as adults.

8. Understanding Credit and Debt

Introducing kids to the basics of credit and debt prepares them for responsible borrowing in the future. Use simple examples, like borrowing a toy from a friend and returning it, to explain the idea of borrowing and paying back. Emphasize that overspending can lead to owing more than you can repay, especially when interest is involved. Explain how credit cards and loans work, and why paying off balances on time is crucial to avoid extra charges. The MyMoney.gov site offers kid-friendly resources for teaching these concepts.

9. The Basics of Earning Money

Kids can learn valuable lessons by earning money through activities beyond standard allowances. Encourage small jobs like yard work, pet sitting, or entrepreneurial ventures such as lemonade stands. These experiences teach the important connection between effort and reward, while also fostering creativity and problem-solving skills. Earning their own money builds confidence and strengthens early work ethics, setting the stage for future professional success. For more ideas on kid-friendly ways to earn, visit NerdWallet’s guide to jobs for kids.

10. The Importance of Giving

Teaching kids to share a portion of their money with others or charitable causes promotes generosity and empathy. Setting aside a “giving jar” or participating in community drives makes the act of giving tangible and meaningful. This habit helps children develop a balanced, healthy relationship with money, understanding that it’s not just for personal gain. Research shows that early experiences with giving can increase life satisfaction and social responsibility.

11. How Banks and Accounts Work

Introducing kids to banks helps them understand the importance of safely storing money. Explain the basic differences between savings accounts, which help money grow with interest, and checking accounts, which allow easy access for spending. Visiting a bank together or exploring kid-friendly banking apps can make these concepts real and less intimidating. Hands-on experiences with banking build comfort and confidence in using financial services as they get older.

12. Protecting Personal Information

Kids need to understand the importance of keeping personal and financial details private. Teach them never to share account numbers, PINs, or passwords with anyone. Use examples of online safety, like recognizing phishing emails or suspicious links, to illustrate potential risks. In today’s digital world, safeguarding financial information is crucial to prevent identity theft and scams.

13. Understanding Interest—Both Earning and Paying

It’s important for kids to learn how interest works in both saving and borrowing. Explain that when they put money in a savings account, the bank pays them a little extra—interest—for every dollar saved. For example, saving $100 at 2% interest earns $2 in a year. On the flip side, borrowing money means paying extra back, often much more over time. Introduce the concept of compound interest, which can help savings grow faster, and compare it to the mounting costs of debt.

14. Learning From Mistakes

It’s natural for kids to make small money mistakes, such as overspending or regretting a rushed purchase. Encourage open discussions about these experiences, sharing stories where things didn’t go as planned and highlighting the lessons learned. This approach helps children develop resilience and see that financial education is an ongoing process. Mistakes are valuable learning opportunities, not failures. For more on turning financial missteps into growth, see guidance from ParentMap.

15. The Importance of Open Money Conversations

Having honest, age-appropriate discussions about money at home sets a powerful example for children. Regular family meetings to talk about budgets, saving goals, or even financial challenges help demystify money and encourage responsible habits. This openness reduces anxiety and builds kids’ confidence in handling finances. When children feel comfortable asking questions, they’re more likely to develop strong money management skills. For practical tips on starting these conversations, visit the Money and Mental Health Policy Institute.

Conclusion

Early financial education has a transformative impact, shaping habits that last a lifetime. Teaching kids these essential lessons is a powerful investment in their future independence and security. Ongoing conversations and hands-on practice—like families creating budgets together or celebrating savings milestones—make the learning real and memorable. Remember, it’s never too early or too late to start building these skills. For more guidance on fostering positive money habits at home, visit Sesame Street’s financial education resources.

.article-content-img img { width: 100% }